FinTech App Development: A Detailed Walkthrough on Types, Features, and Development Costs

Fintech App, short for financial technology, represents a transformative force reshaping the landscape of finance in the 21st century. At its core, fintech embodies the synergy between finance and technology, leveraging innovations to revolutionize how individuals, businesses, and even governments manage, invest, and access money.

In an era where digitalization has become synonymous with progress, fintech stands out as a beacon of innovation, offering solutions that range from mobile banking applications and peer-to-peer payment platforms to sophisticated algorithms guiding investment decisions. This intersection of finance and technology has not only democratized financial services, making them more accessible to a global audience, but also fundamentally altered the way we perceive and interact with money.

Most Common Types Of Fintech App

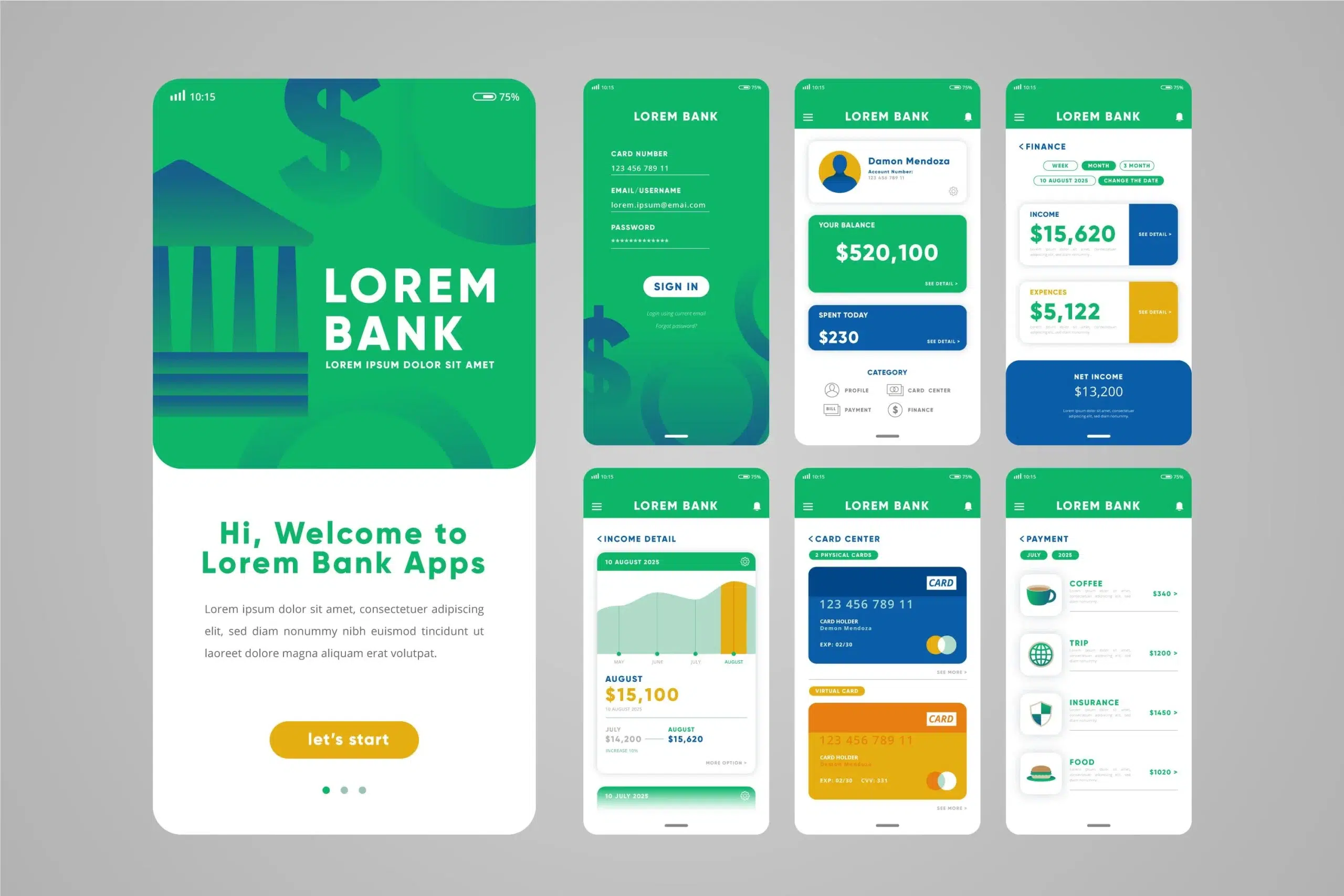

1. Digital Banking:

Fintech has transformed traditional banking services. Customers can check balances, transfer money, and pay bills through user-friendly mobile apps, reducing the need for physical branches.

2. Payment Solutions:

Digital wallets and peer-to-peer payment apps enable swift and secure money transfers. Cryptocurrencies and blockchain technology are also part of this landscape, offering decentralized, fast, and low-cost transactions.

3. Online Lending:

Fintech platforms streamline the lending process. They use algorithms to assess creditworthiness and provide quick loans, revolutionizing personal, business, and even student loans.

4. Investment Management:

Robo-advisors use algorithms to offer automated, low-cost investment advice. They create diversified portfolios tailored to users’ goals and risk tolerance, making investing more accessible to the general public.

5. Insurtech:

Insurance technology, or insurtech, involves digitalizing the insurance industry. It includes online policy management, AI-driven underwriting processes, and innovative policy structures tailored to individual needs.

6. Crowdfunding:

Fintech platforms enable entrepreneurs, artists, and social causes to raise funds directly from the public. Crowdfunding models include peer-to-peer lending, equity crowdfunding, and reward-based crowdfunding.

7. Regtech:

Regulatory technology helps financial institutions comply with regulations efficiently and at a lower cost. It involves software solutions that assist with risk management, regulatory reporting, and compliance monitoring.

8. Data Security:

Fintech emphasizes robust cybersecurity measures to protect sensitive financial data. Technologies such as encryption, biometrics, and AI-driven fraud detection enhance security in digital financial transactions.

Key features of Fintech App

1. Intuitive Design:

Fintech apps prioritize user experience, boasting clean and intuitive interfaces that simplify navigation and financial transactions.

2. Robust Security:

These apps employ advanced security protocols such as data encryption, Transport Layer Security (TLS), and Multi-Factor Authentication (MFA) to safeguard user data and transactions.

3. Unmatched Convenience:

Users can oversee their finances anytime, anywhere, with capabilities including checking balances, transferring funds, making payments, and more, ensuring unparalleled convenience.

4. Seamless Integration

Many fintech apps seamlessly integrate with other popular software, ensuring a smooth financial management experience for users.

5. Artificial Intelligence (AI):

AI integration enhances fintech apps’ capabilities, optimizing operational efficiency, improving customer support, detecting fraud, managing wealth, and more.

6. Data Analysis:

Fintech apps often feature built-in data analytics tools, offering users valuable insights into their spending habits and investment performance.

7. Efficient Automation:

Tasks such as portfolio management and expense tracking are automated, saving users time and effort.

8. Tailored Experience:

Fintech apps empower users to customize their interactions based on personal preferences and financial goals.

Development Costs of Fintech App

Firstly, considering the app’s complexity, from basic functionalities to intricate AI algorithms and real-time data analytics, outlines a significant cost spectrum. Secondly, the choice of platform, be it iOS, Android, or both, and the utilization of cross-platform technologies, such as React Native or Flutter, present diverse cost implications. Additionally, the pivotal role of design and user experience cannot be overlooked; investing in a high-quality user interface escalates the overall expenditure.

Moreover, addressing security needs, including end-to-end encryption and multi-factor authentication, is fundamental. The complexity of integrating third-party services, APIs, and adhering to regulatory standards is another cost-driving factor. Furthermore, the meticulous testing and quality assurance processes, which involve manual and automated testing alongside security audits, add depth to the developmental timeline and costs.

Considering the post-launch phase, regular maintenance, updates, and bug fixes are indispensable for long-term sustainability. Lastly, the location of the development team plays a significant role; teams in regions with higher living costs naturally incur greater charges for their services.

Given this intricate web of factors, providing an exact cost without a detailed project scope is challenging. In light of these considerations, it is highly recommended to collaborate closely with fintech app development companies.

By furnishing them with a comprehensive project outline, you can elicit accurate cost estimates tailored to the specific needs and intricacies of your app. This collaborative approach ensures transparency and precision in financial planning, laying a solid foundation for the successful development of your fintech application.

Conclusion

The evolution of fintech apps marks a significant milestone in the financial industry, ushering in an era of unprecedented convenience, accessibility, and innovation. These apps have fundamentally transformed the way we manage our finances, offering a plethora of features designed to simplify complex financial tasks.

From their user-friendly interfaces that facilitate seamless transactions to their robust security measures ensuring data protection, fintech apps have redefined the banking and financial landscape. The incorporation of cutting-edge technologies such as artificial intelligence and blockchain not only enhances efficiency but also opens doors to new possibilities, shaping the future of financial services.

ONext Digital offers over a decade of expertise in Mobile App Development. Contact us if you require assistance in growing your business. Our skilled professionals are available round the clock, dedicated to delivering top-notch quality service to our clients.